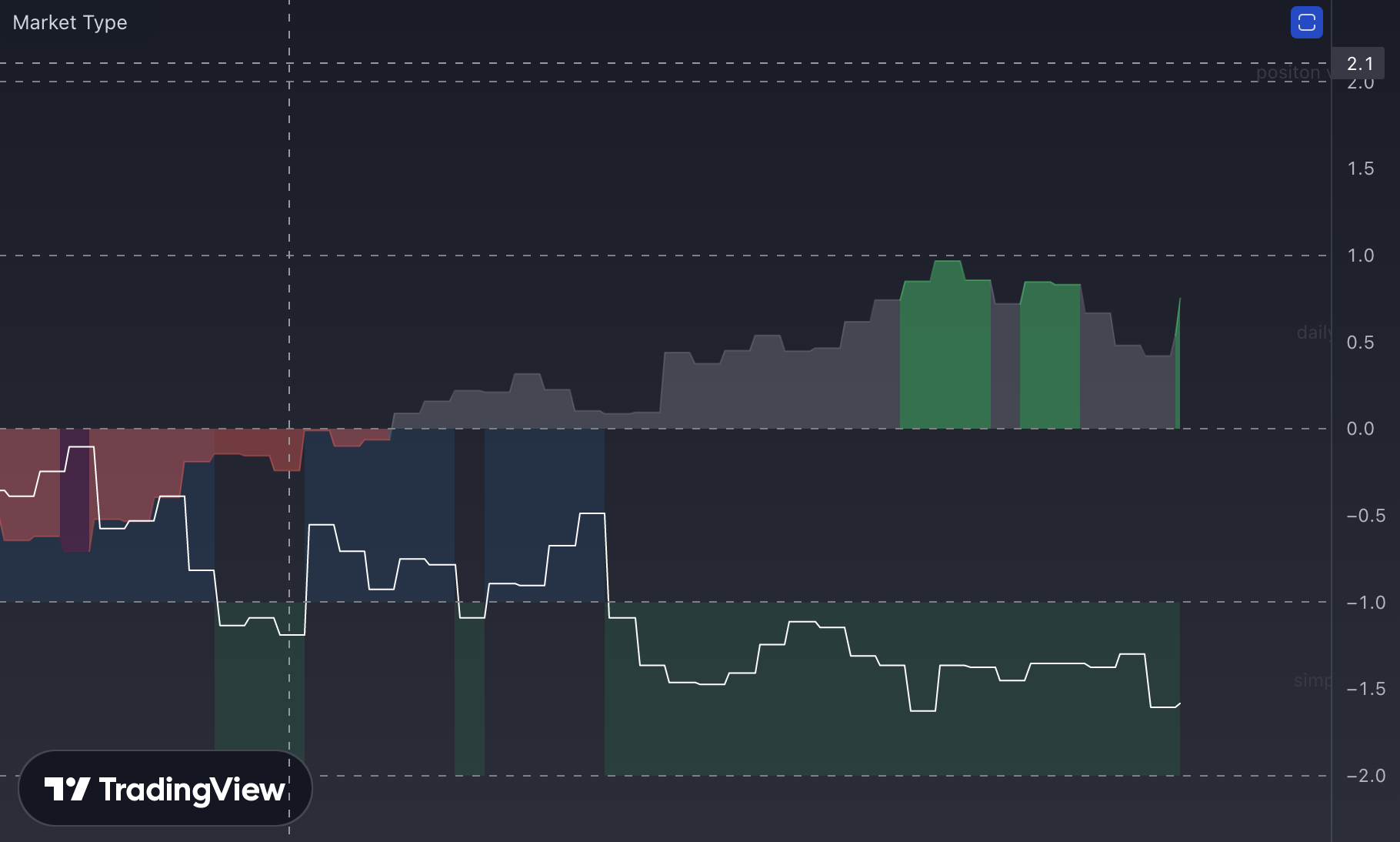

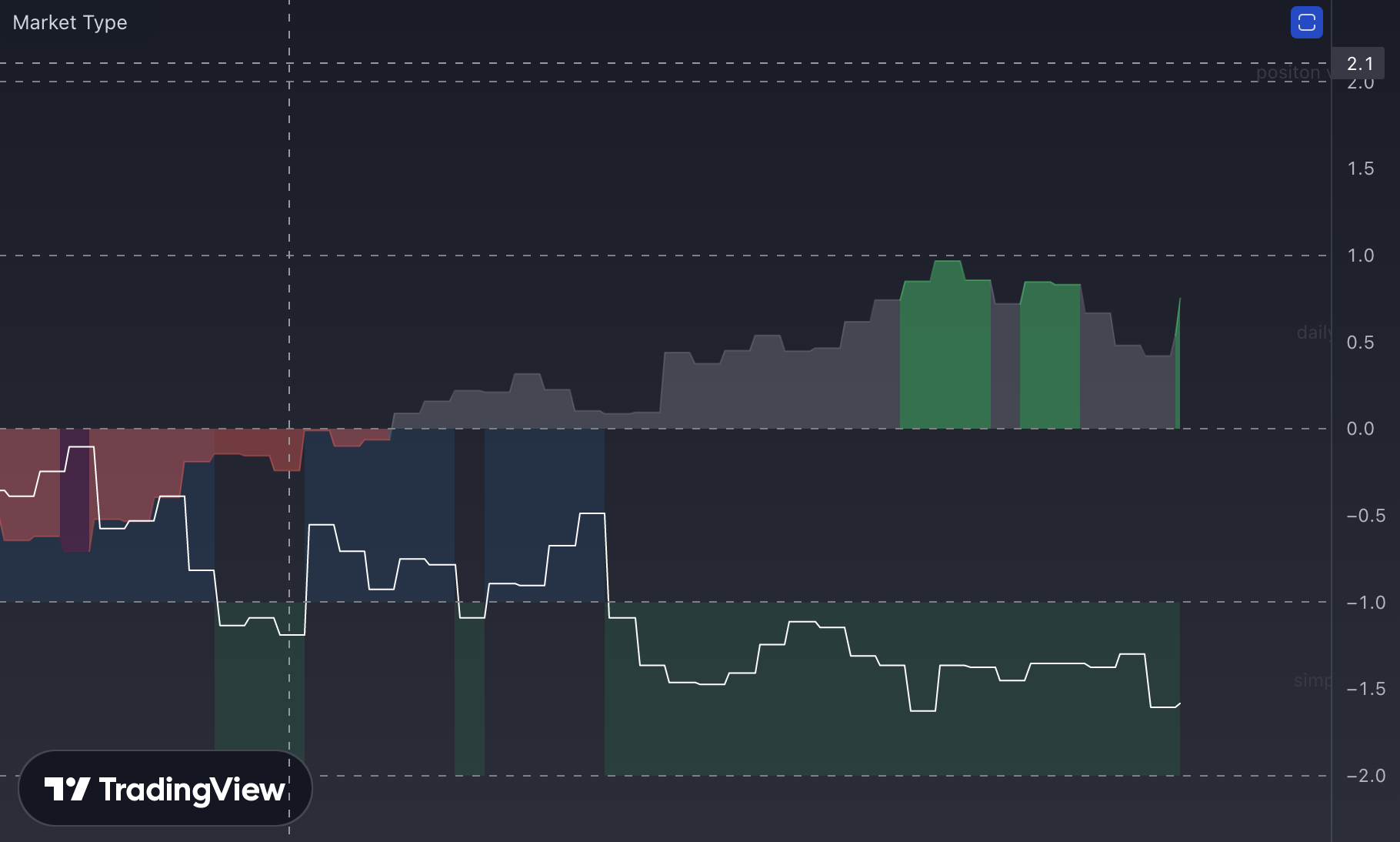

Market Type Trading Indicator

- 15 mins

I was a big fan of Van K Tharp. He talks in his books about defining a market type, so I built a indicator on Tradingview.

What has inside?

- Gulp

- BrowserSync

//@version=4

study(title="Market Type", shorttitle="Market Type", overlay=false)

Period = input(100, minval=5, title="SQN Period")

contracts = input(100, minval=0, type=input.float,title="Contracts")

account = input(60000, minval=100, type=input.float,title="Account Value")

period = input(title = "Display Period", type=input.string, defval="Current", options = ['Day', 'Week', 'Month', 'Current'])

res1 = period == 'Day' ? 'D' : period == 'Week' ? 'W' : period == 'Month' ? 'M' : period == 'Current' ? timeframe.period : 'D'

tfclose=security(syminfo.tickerid, res1, close,barmerge.lookahead_off)

bar_indexw=security(syminfo.tickerid, "W", bar_index, gaps=true)

bar_indexm=security(syminfo.tickerid, "M", bar_index, gaps=true)

bar_indexd=security(syminfo.tickerid, "D", bar_index, gaps=true)

sqnperiodm=bar_indexm<100 and bar_indexm>1?bar_indexm:Period

Dprinos = tfclose / tfclose[1] - 1

dailyclose = security(syminfo.tickerid, "D", close,barmerge.lookahead_off)

weeklyclose = security(syminfo.tickerid, "W", close,barmerge.lookahead_off)

monthlyclose = security(syminfo.tickerid, "M", close,barmerge.lookahead_off)

Dprinosd = dailyclose / dailyclose[1] - 1

Dprinosw = weeklyclose / weeklyclose[1] - 1

Dprinosm = monthlyclose / monthlyclose[1] - 1

Dprinosx = security(syminfo.tickerid, res1, Dprinos,barmerge.lookahead_off)

Stdevx = stdev(Dprinosx, Period)

Stdevxx = security(syminfo.tickerid, res1, Stdevx,barmerge.lookahead_off)

Dprosjekx = sma(Dprinosx, Period)

Dprosjekxx = security(syminfo.tickerid, res1, Dprosjekx,barmerge.lookahead_off)

SQNx = Dprosjekxx * sqrt(Period) / Stdevxx

cx = SQNx > 0.75 and SQNx <= 1.47 ? color.lime :

SQNx > -0.7 and SQNx < 0 ? color.red : SQNx > 1.47 ? color.green :

SQNx <= -0.7 ? color.maroon : SQNx >= 0 and SQNx <= 0.75 ? color.gray : na

plot(SQNx, title="SQNx", color=cx, transp=60, histbase=0, style=plot.style_area, linewidth=1)

Stdevd = stdev(Dprinosd, Period)

Stdevdd = security(syminfo.tickerid, "D", Stdevd,barmerge.lookahead_off)

Dprosjekd = sma(Dprinosd, Period)

Dprosjekdd = security(syminfo.tickerid, "D", Dprosjekd,barmerge.lookahead_off)

SQNd = Dprosjekdd * sqrt(Period) / Stdevdd

cd = SQNd > 0.75 and SQNd <= 1.47 ? color.lime :

SQNd > -0.7 and SQNd < 0 ? color.red : SQNd > 1.47 ? color.green :

SQNd <= -0.7 ? color.maroon : SQNd >= 0 and SQNd <= 0.75 ? color.gray : na

Stdevw = stdev(Dprinosw, Period)

Stdevww = security(syminfo.tickerid, "W", Stdevw,barmerge.lookahead_off)

Dprosjekw = sma(Dprinosd, Period)

Dprosjekww = security(syminfo.tickerid, "W", Dprosjekw,barmerge.lookahead_off)

SQNw = Dprosjekww * sqrt(Period) / Stdevww

cw = SQNw > 0.75 and SQNw <= 1.47 ? color.lime :

SQNw > -0.7 and SQNw < 0 ? color.red : SQNw > 1.47 ? color.green :

SQNw <= -0.7 ? color.maroon : SQNw >= 0 and SQNw <= 0.75 ? color.gray : na

Stdevm = stdev(Dprinosm, sqnperiodm)

Stdevmm = security(syminfo.tickerid, "M", Stdevm,barmerge.lookahead_off)

Dprosjekm = sma(Dprinosm, sqnperiodm)

Dprosjekmm = security(syminfo.tickerid, "M", Dprosjekm,barmerge.lookahead_off)

SQNm = Dprosjekmm * sqrt(sqnperiodm) / Stdevmm

cm = SQNm > 0.7 and SQNm <= 1.47 ? color.lime :

SQNm > -0.7 and SQNm < 0 ? color.red : SQNm > 1.47 ? color.green :

SQNm <= -0.7 ? color.maroon : SQNm >= 0 and SQNm <= 0.75 ? color.gray : na

length = input(10, minval=1)

annual = 365

per = timeframe.isintraday or timeframe.isdaily and timeframe.multiplier == 1 ? 1 : 7

hv = 100 * stdev(log(close / close[1]), length) * sqrt(annual / per)

hv2 = 100 * stdev(log(close / close[1]), length) * sqrt(annual / 7)

pr=percentrank(hv,annual/per)

pr2=percentrank(hv2,12)

prw = security(syminfo.tickerid, "W", pr, lookahead=true)

prd = security(syminfo.tickerid, "D", pr, lookahead=true)

prm = security(syminfo.tickerid, "M", pr2, lookahead=true)

prx = security(syminfo.tickerid, res1, pr, lookahead=true)

prz=(prd-50)/25

przdisplay=(prx-50)/25

plot(przdisplay,color=color.white)

h1 =hline(-2)

h2 =hline(-1)

h3 =hline(0)

h4 =hline(1)

h5 =hline(2)

fill(h1,h2,color=prx<25?color.lime:na)

fill(h2,h3,color=prx>25 and prx<50?color.blue:na)

fill(h3,h4,color=prx>50 and prx<75?color.purple:na)

fill(h4,h5,color=prx>75?color.red:na)

string sqnfloatd = SQNd > 0.75 and SQNd < 1.47?" bull":SQNd > -0.7 and SQNd < 0?" bear":SQNd >= 1.47?" strong bull":SQNd <= -0.7?" strong bear":SQNd >= 0 and SQNd <= 0.75 ?" neutral":"[no data]"

string hvfloatd = prd<=25?" quiet":prd>25 and prd<50?" normal":prd>50 and prd<75?" volatile":prd>=75?" very volatile":"[no data]"

string sqnfloatw = SQNw > 0.75 and SQNw < 1.47?" bull":SQNw > -0.7 and SQNw < 0?" bear":SQNw >= 1.47?" strong bull":SQNw <= -0.7?" strong bear":SQNw >= 0 and SQNw <= 0.75 ?" neutral":"[no data]"

string hvfloatw = prw<=25?" quiet":prw>25 and prw<50?" normal":prw>50 and prw<75?" volatile":prw>=75?" very volatile":"[no data]"

string sqnfloatm = SQNm > 0.75 and SQNm < 1.47?" bull":SQNm > -0.7 and SQNm < 0?" bear":SQNm >= 1.47?" strong bull":SQNm <= -0.7?" strong bear":SQNm >= 0 and SQNm <= 0.75 ?" neutral":"[no data]"

string hvfloatm = prm<=25?" quiet":prm>25 and prm<50?" normal":prm>50 and prm<75?" volatile":prm>=75?" very volatile":"[no data]"

string sqnfloatdsimple = SQNd > 0.75 ?" up":SQNd < 0?" down":SQNd >= 0 and SQNd <= 0.75 ?" sideways":"[no data]"

string hvfloatdsimple = prd<=25?" quiet":prd>25 and prd<75?" normal":prd>=75?" volatile":"[no data]"

float contractvol = (contracts*atr(14))/account*100

string text1 = " " + " daily:" + hvfloatd + sqnfloatd

string text2 = " " + " weekly:" + hvfloatw + sqnfloatw

string text3 = " " + " monthly:" + hvfloatm + sqnfloatm

string text4 = " " + " simple:" + hvfloatdsimple + sqnfloatdsimple

string text5 = " " + " positon volatility: " + tostring(round(contractvol,2)) + "%"

bool drawBar = barstate.islast

if (drawBar)

label l1 = label.new(bar_index, 0.5, text1, color=color.red, textcolor=color.black, style=label.style_none,yloc=yloc.price,xloc = xloc.bar_index)

label.delete(l1[1])

label l2 = label.new(bar_index, 0, text2, color=color.red, textcolor=color.black, style=label.style_none,yloc=yloc.price,xloc = xloc.bar_index)

label.delete(l2[1])

label l3 = label.new(bar_index, -1.5, text3, color=color.red, textcolor=color.black, style=label.style_none,yloc=yloc.price,xloc = xloc.bar_index)

label.delete(l3[1])

label l4 = label.new(bar_index, -1.5, text4, color=color.red, textcolor=color.black, style=label.style_none,yloc=yloc.price,xloc = xloc.bar_index)

label.delete(l4[1])

label l5 = label.new(bar_index, 2, text5, color=color.red, textcolor=color.black, style=label.style_none,yloc=yloc.price,xloc = xloc.bar_index)

label.delete(l5[1])